ADVERTORIAL • April 2020

The business traveller’s bank

Whether you’re a limited company or other registered business, the last thing you want is to be grappling with endless admin. With Starling, a new-generation digital bank, you’ll have more time to grow your business and enjoy the important things in life. Business travel writer Helen Nugent, tells us more…

Ready, set, go

No fuss, no muss, no waiting around. It’s quicker to sign up to Starling’s free business account than you could ever imagine. With a simple in-app application and no monthly fees, you’re in safe (and speedy) hands. No wonder Starling was voted Best Business Banking Provider 2020 at the British Banking Awards.

Any time, any place, anywhere

It doesn’t matter if you’re sitting at your desk or relaxing on the sofa. With this business account, you can connect to your accounting software at the touch of a button. And, just think, you’ll never have to manually upload a statement again.

Off the Ground

Watch the latest ad here

Need a hand?

If you’re working, so is Starling. Whether you’re a night owl or up with the dawn chorus, your bank is there for you 24/7 by phone or app. And don’t worry about security – Starling has world-class protection. Plus, your money is protected up to a sum of £85,000 by the Financial Services Compensation Scheme.

Joined-up thinking

Starling knows that in today’s world you want your bank account to be straightforward, sprightly and simple to use. That’s why it created the Starling Business Marketplace (pictured below). As well as instant access to your accountancy software, Marketplace offers a range of third-party products that you can link to your Starling account. Hand-picked to help your business flourish, they include tax, lending, insurance, legal and mortgages.

Secure in the knowledge

Every little helps, so the saying goes. Whenever a payment leaves or enters your account, you’ll receive a real-time notification on your smartphone, leaving you time to get on with running your business. And Starling will automatically put your expenses into business categories to simplify your reporting.

Easy cash deposits

We may live in an increasingly cash-free society, but you never know when you might need to deposit some of the paper stuff. Thanks to a nifty partnership, you can head to any local Post Office and deposit cash directly into your Starling account. The deposit service is free for personal customers and costs just £3 for business customers depositing up to £1,000.

Flexible banking

There’s nothing like peace of mind, particularly when it comes to finance. There if you need it, Starling’s flexible overdraft is available by using the in-app slider to adjust how much you need, as well as how much it’ll cost you. So, whether you’re a limited company or sole trader, or want a multi-director or euro account, Starling can help your business to fly.

This article has been tagged Advertorial, Technology

More from previous issues

Pilot talk: top tips for your next long-haul flight

Flying long haul can sometimes feel like an endurance test, but it can also be the perfect opportunity to grab some well-deserved time for yourself. A pilot tells us how…

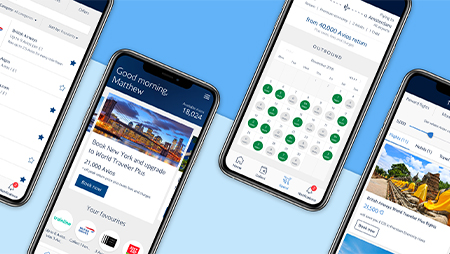

App hacks: how to get the most from the BA apps

Executive Club Members have exclusive access to an app that, when used in conjunction with the British Airways app, makes every journey a seamless experience

The UK’s loveliest springtime walks with pubs

Spring in your step: before summer arrives, take advantage of this gentle season to discover the UK’s glorious countryside – and its welcoming ale houses

The best of BA news

A new codeshare agreement with Royal Air Maroc means a greater choice of destinations in Morocco, plus the next Jamie Lloyd Company production, as sponsored by British Airways, is revealed