ADVERTORIAL • December 2019

Introducing the best British bank card for travellers

You’ve booked the flights and accommodation. Personal insurance has been taken care of and you’ve bought yourself a jazzy new holiday shirt, so the next step is arranging your foreign currency with the company voted Best British Bank for two years running. Starling Bank, which doesn’t charge you when using your card abroad, makes for the perfect companion on a winter break. Here’s The Club’s guide to shrewd spending overseas this Christmas

No fees overseas

You shouldn’t have to pay to access your own money and the same applies during your winter break this Christmas. Leave concerns about overseas fees at home, and enjoy peace of mind from knowing that Starling Bank won’t charge you to use your debit card abroad (and they won’t add ATM fees, either). Occasionally, ATMs will charge their own fees, but, unlike most banks, Starling will never add anything on top.

Lock your account

Losing your debit card on holiday can be a consequence-filled interruption to your well-deserved rest and relaxation. Starling Bank, however, allows you to lock all card transactions from its handy app. You don’t even have to be concerned about needing access to cash, as an unlocked digital wallet means that you can use Apple or Google Pay until a replacement card arrives. If you find it again, you can just unlock it, meaning no need to order a new card. If that wasn’t enough, Starling’s UK based customer support team is on hand 24/7 — if you’re nine hours ahead, so are they.

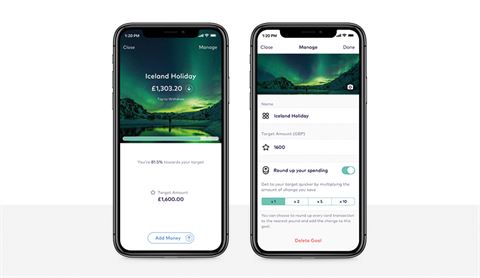

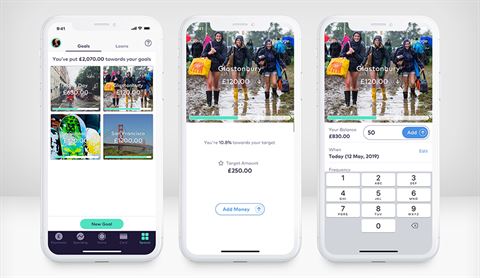

Stay in control

Keeping tabs on your holiday spending to avoid exceeding the bank’s cap on your feeless transactions can be a challenge for the best of us, particularly when you factor in a lunchtime glass or two of wine. It’s easy to stay in control with Starling though as you’ll receive a notification of how much you’ve spent in your local currency and what that equates to in pounds. It’s what you might expect from a bank voted Best Current Account Provider at the 2019 British Bank Awards.

Master the exchange rate

It’s your very own Bureau de Change. Starling utilise Mastercard’s globally accepted exchange rate meaning that there’s one less thing for you to take care of in the run up to your winter break. Plus, there are no fees added on top by Starling. None at all. And, to ensure you make your money go further, Starling advise that when it comes to paying the bill you do so in the local currency to benefit from the exchange rate.

Avoid awkward conversations

Whether you’ve escaped to Europe for a few days or chased the sun further afield, settling the restaurant bill abroad among a group can be a frustrating exercise. Starling simplify this. All that’s needed is for one person to pay the bill and then split it by sending a Settle Up request for the amount owed. There are no sort codes or tricky reminders to deal with and you can even send money with the help of Nearby Payments while you’re still sat at the table.

To find out how to make travel easier with Starling, click here

This article has been tagged Advertorial, Travel Tips

More from previous issues

Seven enchanting ice-skating rinks

Winter brings ice, and ice brings fun, so where better to get your skates on than at any of these ice-skating rinks, from Canada to Hungary

Austria for every kind of traveller

With a classical music heritage, delicious sweet treats and the white peaks of the Alps as a backdrop, Austria has all the wonders you could wish

The best of BA news

A new route launch to Turkey's Turquoise Coast is announced for spring 2020, the A350 takes off to Toronto, plus the airline commits to offsetting carbon emissions on domestic flights

My Club: Dan Price

Dan Price, Executive Club Member and co-founder of My 1st Years, talks travel experiences, networking and the journey that is parenthood