ADVERTORIAL • December 2020

The debit card teaching your kids about money

December – a month where cheques and Christmas cards concealing cash typically find their way into the hands of children across the UK. But, with the Covid-19 pandemic making many of us wary about handling coins and notes, even Santa might have to go cashless this year.

Luckily, digital money for kids is here not only to save Christmas, but to give your young ones the chance to learn the importance of money management. Finance writer and broadcaster Iona Bain takes a look at how the newly launched Starling Kite is doing just that

All in one place

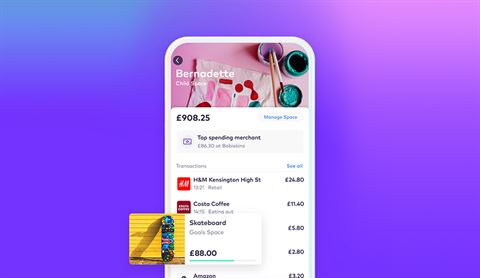

Starling’s all-new Kite card is aimed at those between the ages of 6 and 16. It gives the user a world of independence, but still offers parents ultimate visibility, as Starling Kite is embedded into the adult's account. This means you control everything from one (award-winning) app. Ping over cash whenever you like, in regular or one-off payments, and they can spend it using their very own shiny new Kite debit card.

Top tip: In today’s whirlwind of consumer advertising and social media, kids are under more pressure to spend than ever. Why not sit down and talk through their spending choices – do they really want that toy or game or shirt? Will the thrill of buying today wear off next week? Might something else be better value?

View this post on Instagram

Parental control

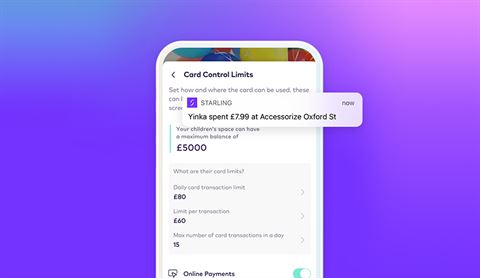

Come the new year, a linked Kite app will let them visualise their money from their own phones and iPads, so they can view their balance and keep track of their spending. But you’ll get an instant notification every time they tap, and a view of their spending history. You can set payment limits on certain types of transactions – that way they can’t blow all their cash at a favourite store, for instance. Plus, with no overdraft there’s no chance to spend what they don’t have.

Top tip: Kite can help kids learn that crucial life lesson: when money’s gone, it’s gone! Introduce them to the concept of budgeting and encourage them to set limits on how much they spend at any retailer.

Savings goals

We all know that learning how to save and grow your money for the future is important, especially during these difficult times. Good news, then, that setting saving goals is on the agenda with Starling’s teen app, taking aim at 16-to-17-year olds finding their financial feet. These teens can make instant payments to friends and manage their own funds via the app, all under the distant eye of a parent.

Top tip: Why not offer them an incentive to keep hold of their money? They’ll learn the value of delayed gratification and the concept of saving for a rainy day. You could introduce the idea of working for their money by paying them for completing household chores or for special achievements at school.

View this post on Instagram

Safety first

Starling Kite is safer than cash – children who get signed up receive a proper card with their name on, which can be cancelled instantly if the card gets lost or stolen. Your control over where it can be used means safety online, and it’s already blocked age-inappropriate venues including pubs and gambling outlets.

Top tip: Your child will have responsibility for keeping their card and PIN safe. So find fun ways to teach them this – for younger kids, their PIN could be a secret code to be memorised.

Banking support

Starling is a fully licensed bank, and therefore protected to have a kids card. Accounts are covered by FSCS protection of up to £85,000. There’s 24/7 online customer support, too. Kite’s flat monthly fee of £2 is 99p cheaper than the leading competitor, and there are no extra charges at Starling for ATM withdrawals, transfers or on purchases made abroad.

Parting wisdom: The way we manage money is changing, so our financial lessons in the home need to evolve, too. Thankfully, Kite can help your child get their lifelong relationship with money off to a brilliant start. You can’t give them a better Christmas present than that!

This article has been tagged Advertorial, AV FUN

More from previous issues

The best of British Airways news

We reveal the First cabin’s updated seating, and why it’s time to convert your Tesco Clubcard points to Avios

Five epic drives: Jenson Button

If you want to know where to find the best roads, ask the best drivers. This issue, we do just that

My Club: Andi Oliver

Ahead of her appearance in this year’s Great British Menu, we chat to frequent flyer and chef Andi Oliver about her foodie travels

A Member’s guide to the Maldives

We’d all rather be in the Maldives right now, wouldn’t we? Luckily, our writer and Executive Club Member made it there just in time