ADVERTORIAL • January 2020

Save money and travel the world with Starling Bank

Whether a bucket-list trip, cultured city break or mellow beach getaway, nothing beats the January blues like planning your next holiday. But while travelling may be fun, saving up for it is less so. Starling, a new-generation digital bank, can help you knock your finances into shape, so you’re all set for your globetrotting adventures. Here’s how...

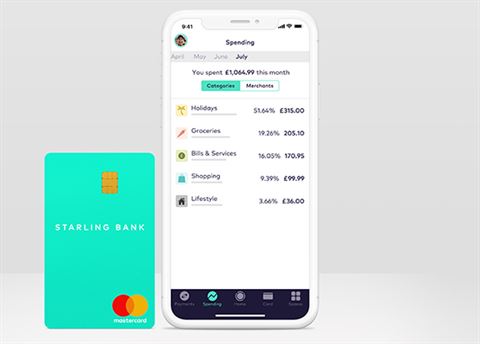

Knowledge is power

You’ll likely be up to speed as to what’s coming into your account, but have you any idea what’s really going out? That everyday extra-shot latte, the grocery delivery, Saturday night at the cinema... it all adds up. Starling’s mobile banking app collates all your data, giving monthly reports on exactly where, when and how you are spending, allowing you to manage your budget and trim your spending more effectively.

An end in mind

Heart set on a romantic weekend in Venice? Or perhaps you’re thinking more along the lines of a once-in-a-lifetime trip around the world. Either way, the app’s Our Goals feature allows you to create and customise your own savings plan to turn that dream into reality. Set a target (add a photo to visualise what you’re saving for) and start putting money aside – you can do this via automatic regular payments or as and when.

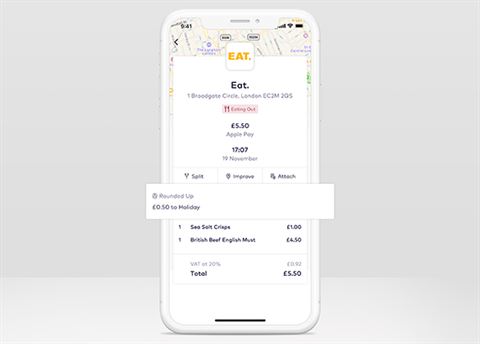

Look after the pennies…

It was a wise person who once said, ‘Look after the pennies and the pounds will look after themselves’, and with the app’s Round Up feature, you can make this happen (no piggy bank required). Transactions are rounded up to the nearest pound, with any change automatically going into your savings – you can even multiply your Round Up by two, five or ten. Before long, your digital change jar will be overflowing.

In your interest

Less is more, but not when it comes to your finances. Starling is the only challenger bank that pays interest on current account balances – it’s competitive, too, offering 0.5% AER up to £2,000 and 0.25% up to £85,000. Essentially, you’re increasing your holiday fund without doing anything.

Zero fees overseas

Starling is the perfect travel companion, whether holidaying with friends and family or away on business. Go abroad safe in the knowledge that Starling won’t charge you for card payments or ATM withdrawals, and you’ll get a globally-accepted exchange rate. You’ll also receive notifications on your phone of how much you’ve spent in the local currency and what that equates to in sterling. Lost your card? Temporarily lock it at the touch of a button.

Free and easy

Starling has won Best British Bank (twice) and Best Current Account 2019 at the British Bank Awards (aka the Oscars of the banking world), so you’re in excellent hands. And the best bit? You can open an account for free. The application only takes minutes and won’t cost a penny, leaving you all the more to put towards that epic trip you’ve been planning.

Finger on the pulse

Whenever a payment leaves or enters your account, the app will send a notification in real-time on your phone. A little extra security against fraud, yes, and also no surprises when you check your bank balance, as you’ll be completely in the loop with ingoings and outgoings.

This article has been tagged Advertorial, Travel Tips

More from previous issues

My Club: Elanor Dymott

We talk to London-based author, Elanor Dymott, and find out how childhood flights with British Airways helped shape the woman she's become

How to upgrade with Avios

Everyone loves an upgrade, and it turns out you might just have enough Avios to bag one. Let our handy guide show you how

How BA helps Santa Claus deliver Christmas

Over the Christmas period, Brits will cover some two billion miles in the delivery of our Christmas post, but what part does British Airways play?

The top 10 must-dive sites for 2020

Deep thoughts: diving specialist John Alexander reveals his favourite places to delve beneath the surface and enter another world